Investable Strategy

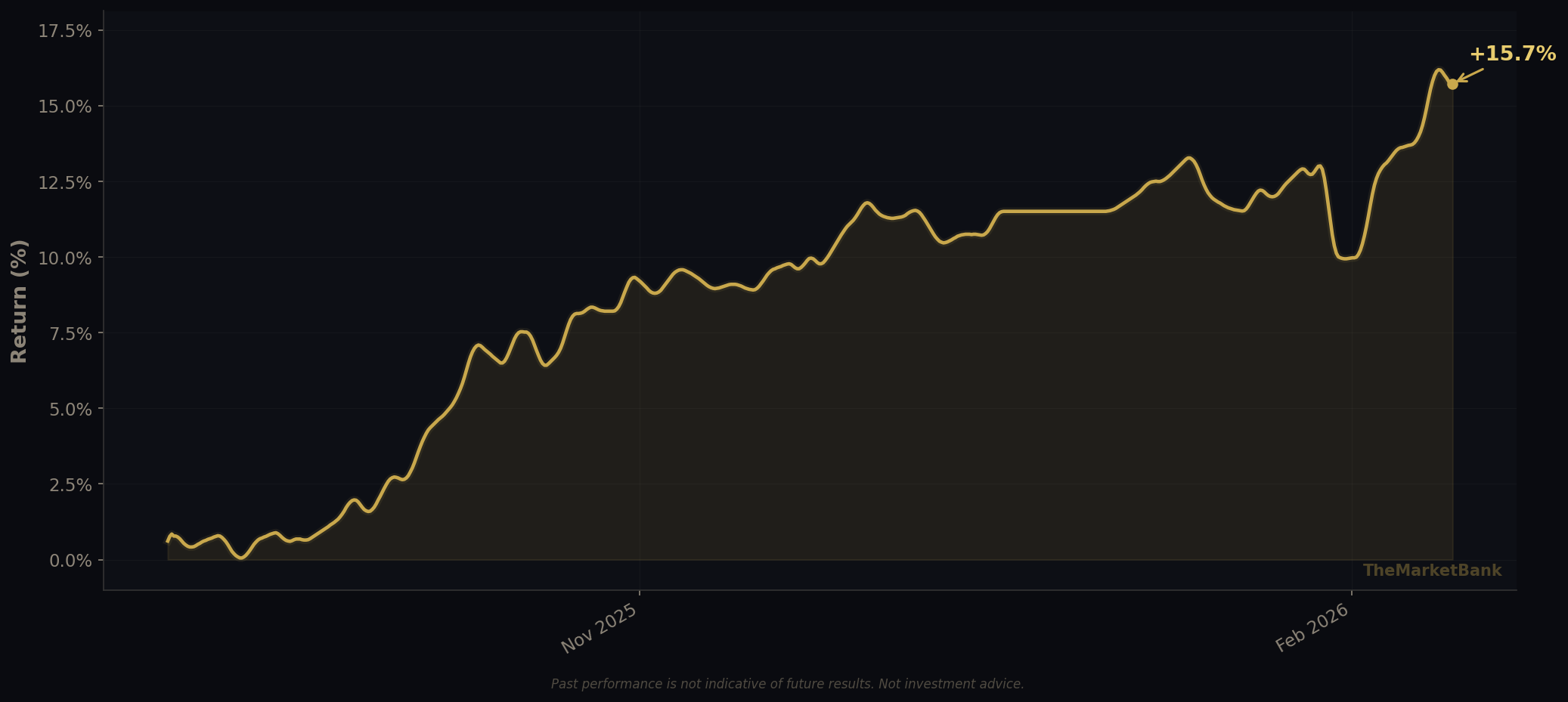

QWK Darwin — a risk-normalised, investable asset powered by our systematic strategy, regulated through Darwinex.

Gross returns before 1.2% management fee & 20% performance fee. Past performance is not indicative of future results.

Assets Under Management

Total capital currently invested in the QWK Darwin across all investors.

Includes Darwinex capital allocation. A portion of total AuM is capital allocated by Darwinex under their DarwinIA programme, not external investors.

Markets We Trade

A focused selection of liquid, uncorrelated asset classes providing diversified alpha sources.

How It Works

A transparent, three-step path from strategy to investable asset.